Maximize Your Savings with Solar Incentives and Tax Credits: How to Save Big in 2024

Updated: 13 Nov 2024

142

Introduction

Switching to solar energy is more affordable than ever, thanks to solar incentives and tax credits: how to save big in 2024. These financial benefits, offered by the government and some utility companies, help reduce the upfront cost of solar panel installations, making it easier for homeowners and businesses to go green.

Whether you’re looking to lower your electricity bills or make a positive impact on the environment, these incentives can help you save a substantial amount. In this guide, we’ll explore everything you need to know about the 2024 solar incentives and tax credits, from federal tax credits to local rebates, so you can make the most of your solar investment.

What is “Solar Incentives and Tax Credits: How to Save Big in 2024”?

“Solar Incentives and Tax Credits: How to Save Big in 2024” refers to the various financial benefits available to help individuals and businesses afford the switch to solar energy. These incentives, provided by federal, state, and sometimes local governments, are designed to make solar more accessible and encourage more people to adopt renewable energy.

Incentives and tax credits help reduce the upfront and long-term costs of installing solar panels by allowing homeowners and businesses to claim a portion of the installation cost as a tax deduction or credit. Here’s how they work and why they’re important:

- Federal Tax Credit: The federal government offers a tax credit that covers a percentage of your solar installation costs, allowing you to claim a portion of what you spent as a reduction on your income taxes.

- State and Local Credits: Some states offer additional tax credits or incentives on top of the federal credit, further reducing installation costs.

- Utility Rebates: Some utility companies provide rebates, making it more affordable to purchase and install solar systems.

- Net Metering Benefits: Certain states allow net metering, where you can earn credits or payments for excess electricity generated by your system.

These incentives and credits are valuable tools for anyone looking to save big in 2024 by switching to solar. They lower the overall cost and improve the return on investment, making solar power a more attractive option for homeowners and businesses alike.

1. What is a Solar Tax Credit?

- Define what a solar tax credit is in simple terms.

- Explain its purpose in encouraging renewable energy adoption.

- Briefly mention how it reduces the cost of solar installations.

- Highlight its availability at both federal and state levels.

- Discuss the financial impact for homeowners and businesses.

2. Why Are Solar Tax Credits Important?

A paragraph explaining why tax credits are essential for making solar energy accessible, reducing environmental impact, and supporting state and national renewable energy goals.

3. How Do Solar Tax Credits Work by State?

- Describe the basic process of applying for state solar tax credits.

- Mention how these credits vary by state in percentage and availability.

- Explain the difference between tax credits, rebates, and incentives.

- Note any specific rules or conditions common to state programs.

- Highlight the potential impact of these credits on installation costs.

4. Federal Solar Tax Credit vs. State Tax Credits

A paragraph contrasting the federal solar tax credit with state-level credits, emphasizing how homeowners can use both to maximize savings.

5. Top States with the Highest Solar Tax Credits

- California

- New York

- Massachusetts

- New Jersey

- Arizona Each bullet can have a short note on the percentage, availability, or benefits specific to each state.

6. How to Apply for Solar Tax Credits by State

- Gather necessary documents like installation receipts and proof of payment.

- Visit your state’s renewable energy website or tax portal.

- Complete the application form, if required, or include the credit in your tax filing.

- Submit any additional documentation as required by the state.

- Avoid common mistakes like missing deadlines or incomplete forms.

7. Common Eligibility Requirements for Solar Tax Credits by State

- Ownership of the solar system (not leased).The system must be newly installed (certain year restrictions may apply).

- Proof that the solar system meets local and federal energy standards.

- Some states require that the installation is done by a certified professional.

- Availability of credits may depend on property type (residential vs. commercial).

8. Additional Solar Incentives by State

A paragraph explaining other types of state-level solar incentives, like rebates, grants, and low-interest loans, which can further reduce installation costs.

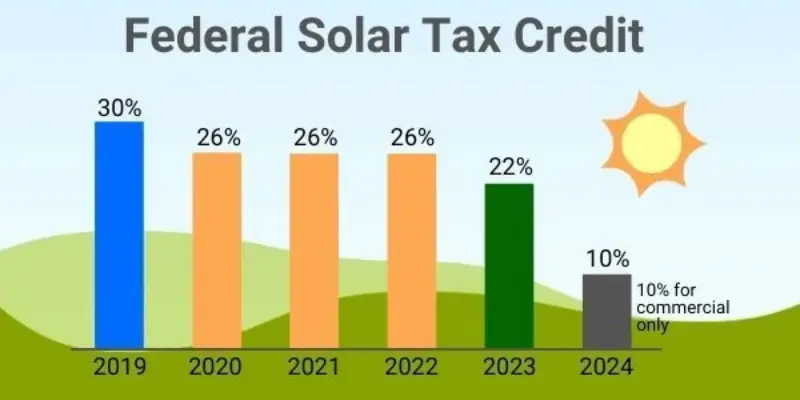

9 Changes in Solar Tax Credits for 2024

- Any potential changes in the percentage or availability of tax credits.

- New state initiatives or reductions in certain areas.

- How upcoming policy changes might impact eligibility.

- New requirements or incentives set by state governments.

- Why it’s beneficial to take advantage of current credits before changes take effect.

10. How Solar Tax Credits Can Impact Your Savings

Conclude with a summary of how solar tax credits by state can lead to significant savings, encouraging readers to explore their options and act to maximize both financial and environmental benefits.

Step-by-Step Guide on Solar Incentives and Tax Credits: How to Save Big in 2024

This guide walks you through each step of solar incentives and tax credits: how to save big in 2024, helping you make the most of available programs to reduce the cost of going solar. From understanding federal and state incentives to applying for credits and tracking your savings, this step-by-step approach will ensure you maximize financial benefits and take full advantage of solar energy savings in 2024.

Step 1: Understand Solar Incentives and Tax Credits

- Federal Tax Credit: Know that the federal government offers a tax credit that covers a percentage of your total solar installation cost, which you can claim on your income tax return.

- State and Local Incentives: Check your state and local government for additional tax credits, rebates, and incentives that may be available in your area.

- Utility Company Programs: Some utility companies offer rebates or net metering programs, allowing you to sell excess energy back to the grid.

Step 2: Research Available Incentives in Your State

- Look up state-specific incentives through resources like the Database of State Incentives for Renewables & Efficiency (DSIRE).

- Visit your state’s energy office or renewable energy website for current incentives and tax credit information.

- Check with your utility company about any additional rebates or benefits they may offer for solar installations.

Step 3: Confirm Your Eligibility

- Ownership: Ensure you own the solar system rather than leasing, as many incentives apply only to owned systems.

- Certification: Make sure your solar installation meets state and federal standards, as some incentives require certified products or installations.

- Timelines: Note any deadlines for applying, especially as incentives for 2024 may have time restrictions or limited availability.

Step 4: Gather Necessary Documentation

- Collect purchase receipts, contracts, and installation invoices, as these are typically required for tax credit applications.

- Obtain proof of compliance if your state requires certified installers or specific equipment standards.

- Keep all relevant paperwork organized, as you may need these documents for tax filing or rebate applications.

Step 5: Apply for Federal and State Tax Credits

Federal Tax Credit: Use IRS Form 5695 when filing your federal taxes to claim the solar tax credit.

State Tax Credits: Review your state’s application requirements, which may include online applications or additional forms when filing your state taxes.

Utility Rebates: Apply for rebates through your utility company, often requiring an online application and proof of installation.

Step 6: Take Advantage of Net Metering (If Available)

- Check if your state or utility offers net metering, which allows you to earn credits or payments for excess electricity generated by your solar system.

- Ensure your system is eligible and connected to the grid; some states have specific requirements for net metering programs.

- Track your energy production to understand how much you’re saving or earning through net metering.

Step 7: Consult a Tax Professional (Optional)

- If you’re unsure about filing for credits or calculating the exact amount, consider consulting a tax professional or solar advisor.

- A tax professional can ensure you’re claiming all eligible credits, saving you both time and maximizing your savings.

Step 8: Plan for Future Changes in Incentives

- Keep updated on changes to solar incentives, as some programs are set to decrease or end after 2024.

- Consider installing your system sooner to lock in current incentives and avoid potential policy changes.

- Sign up for energy or government newsletters for updates on renewable energy programs and incentives.

Step 9: Monitor Your Savings and System Performance

- Track your monthly electricity bill to see the impact of your solar system and incentives on your energy costs.

- Regularly monitor your system’s performance to ensure you’re maximizing savings, as efficient systems yield higher returns.

- Review your incentive savings at the end of the year, noting any additional credits or rebates for the following tax season.

Step 10: Enjoy the Long-Term Benefits of Solar Energy

- Appreciate the ongoing savings from reduced electricity bills and the environmental impact of using renewable energy.

- Remember that with solar incentives and tax credits, your investment in solar energy will continue to save you money for years to come.

- Stay aware of any future incentives for system upgrades or battery additions to further enhance your energy savings.

Advantages and Disadvantages of Solar Incentives and Tax Credits: How to Save Big in 2024

| Advantages of Solar Incentives and Tax Credits: How to Save Big in 2024 |

|---|

Cost Reduction: Solar incentives and tax credits help lower the initial cost of solar installations, making it easier for more people to afford the switch. |

| Disadvantages of Solar Incentives and Tax Credits: How to Save Big in 2024 |

|---|

Limited Availability: Some state incentives are only available in certain areas, meaning not everyone can access the full range of benefits. |

Conclusion

Taking advantage of solar incentives and tax credits in 2024 is one of the best ways to make solar power affordable and accessible. By understanding federal, state, and utility incentives, you can significantly reduce the cost of installation and start saving on energy bills sooner. These programs not only cut costs but also help you make a positive environmental impact. With the right steps, you’ll maximize savings and enjoy the long-term benefits of clean, renewable energy for years to come.

What are solar incentives and tax credits?

Solar incentives and tax credits are financial benefits provided by the government and utility companies to help lower the cost of solar panel installation. They can include tax credits, rebates, and net metering programs that make solar more affordable.

How much can I save with solar incentives and tax credits?

The savings vary depending on your location, the size of your solar system, and available incentives. The federal tax credit alone can cover a significant portion of the installation cost, with state and local incentives adding even more savings.

How do I qualify for solar incentives and tax credits?

Generally, you must own the solar system and have it installed by a certified professional to qualify. Each state may have specific requirements, so it’s best to check local guidelines.

Can I combine federal and state solar tax credits?

Yes! You can use both federal and state tax credits, which helps maximize your savings. Just be sure to review each program’s requirements to ensure you’re eligible for both.

How do I apply for the federal solar tax credit?

To apply, you’ll need IRS Form 5695 when filing your taxes. Include this form along with the cost of your solar installation to claim the federal tax credit on your tax return.

Bonus Points

- Enhanced Property Value: Homes with solar installations often have higher resale values. The availability of tax credits helps make solar an even more attractive long-term investment.

- Reduced Carbon Footprint: By switching to solar, you’re contributing to a cleaner environment and reducing reliance on fossil fuels. Incentives make this switch more affordable, making it easier to have a positive environmental impact.

- Protection Against Rising Energy Costs: Solar power protects you from future increases in electricity prices. Incentives and tax credits reduce upfront costs, allowing you to secure a stable energy source at a lower price.

- Community and Business Incentives: Some states and localities offer additional incentives for community solar projects and businesses, allowing shared savings and broader solar access.

- Battery Storage Benefits: In some states, incentives extend to solar battery storage, allowing you to save on battery installation. This makes energy storage more affordable, providing backup power during outages and maximizing solar usage.

- Time-Limited Opportunities: 2024 may be one of the last years to receive certain solar incentives at their current levels. By acting now, you can lock in these savings before potential future reductions.

- Low Maintenance, High Savings: Solar panels are low-maintenance, so once you’ve installed them, you’ll enjoy consistent energy savings with minimal upkeep. Incentives help lower initial costs, maximizing your return on investment.

- Supporting Local Jobs: By investing in solar, you’re also supporting local solar companies and job growth in the renewable energy sector. Many incentive programs aim to strengthen this economic impact.

- Future-Proofing Your Home: As more homes go green, adding solar now makes your property future-ready. Incentives reduce the upfront cost, making this upgrade financially appealing.

- Educational Benefits: Taking advantage of solar incentives can introduce you to other sustainability programs, like energy-efficient home improvements, which often have their own tax benefits.

Please Write Your Comments